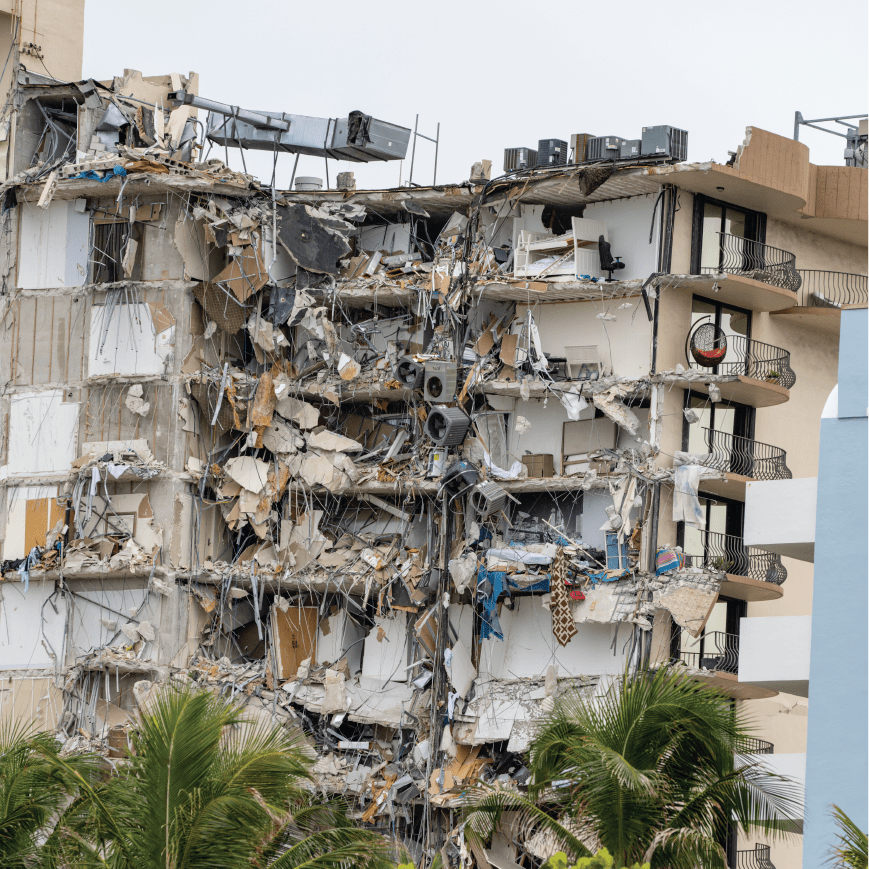

AICPA Seeks Quick Relief on Interruption of LIFO Inventories and 3 more topics! Nichols Tax Update Issue 21-34

Nichols’ Tax Update Podcast: Issue 21-34 Aunt Entitled to Child Tax Credits, Dependency Deductions The Tax Court, in a summary opinion, held that an individual is entitled to dependency [...]